What Is Cryptocurrency? The 2025 Beginner’s Guide to Digital Money, Blockchain, and Building Generational Wealth

Cryptocurrency is transforming global finance — but most beginners still don’t understand what it actually is or how it works. In this guide, you’ll learn the basics of digital money, blockchain technology, why some coins become valuable, and the biggest mistake that costs new investors thousands. A perfect starting point for anyone entering crypto in 2025.

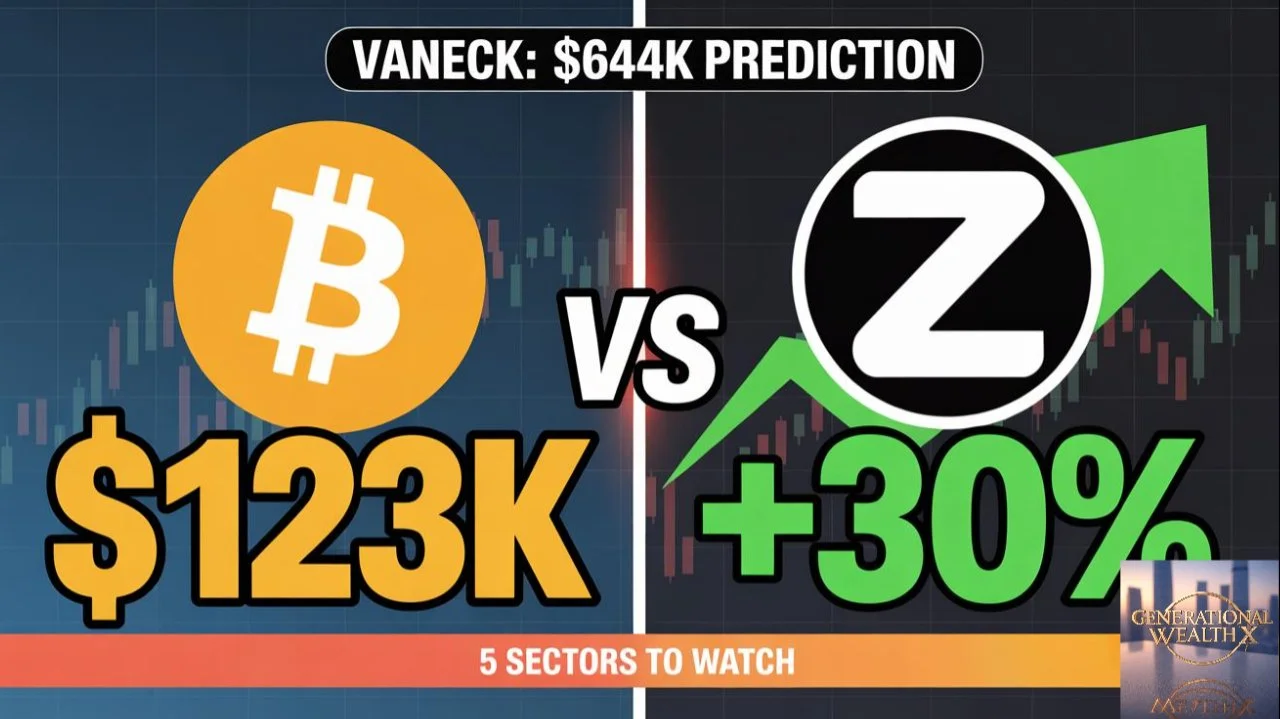

Bitcoin Inches Closer to $100,000: The Twenty-Four Hour Crypto Shift No One Saw Coming

Bitcoin inches closer to $100,000 as XRP rallies, Visa expands stablecoin payments, Upbit suffers a $37 million Solana hack, and global crypto regulations heat up. Here’s everything that moved the markets in the last 24 hours.