What Is Cryptocurrency? The 2025 Beginner’s Guide to Digital Money, Blockchain, and Building Generational Wealth

Cryptocurrency is transforming global finance — but most beginners still don’t understand what it actually is or how it works. In this guide, you’ll learn the basics of digital money, blockchain technology, why some coins become valuable, and the biggest mistake that costs new investors thousands. A perfect starting point for anyone entering crypto in 2025.

Is Solana The Next Ethereum? Let's Break It Down

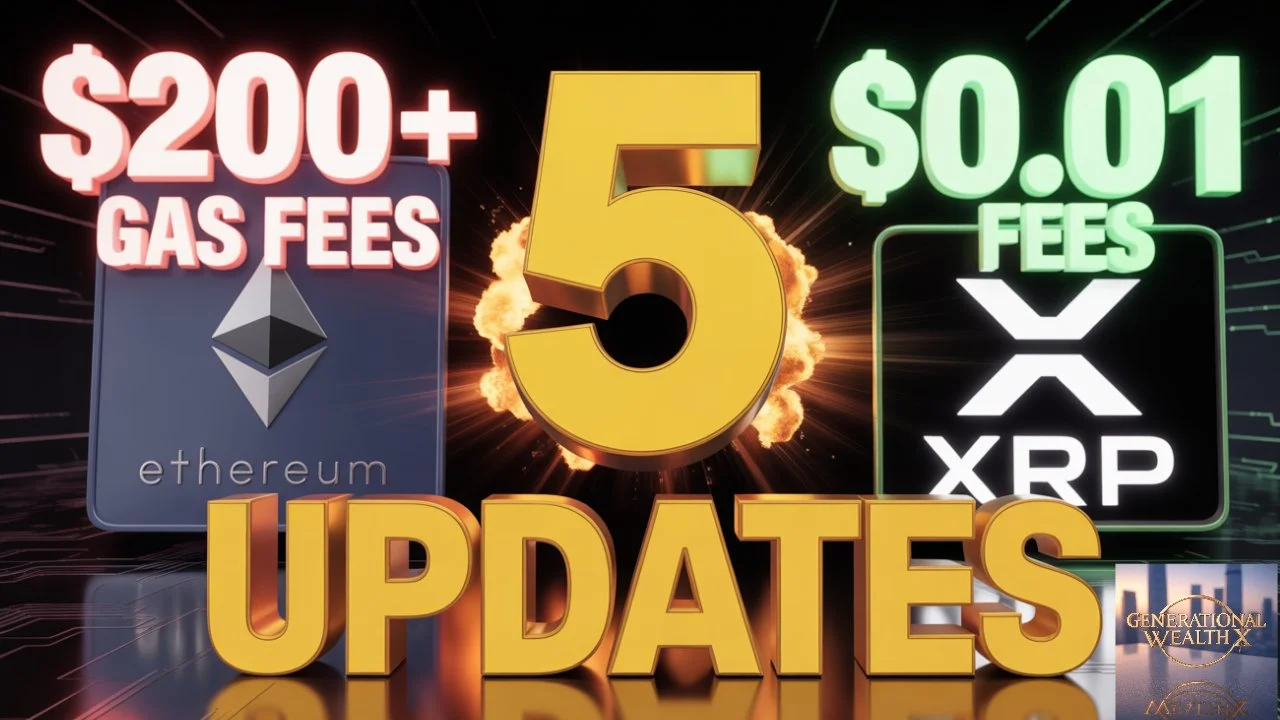

For years, Ethereum has worn the crown, but we've all felt the pain of its crippling gas fees. Now, a rival has emerged, built for insane speed and near-zero cost. Can this challenger, Solana, actually dethrone the giant, or is it just a pretender?